how much does the uk raise in taxes

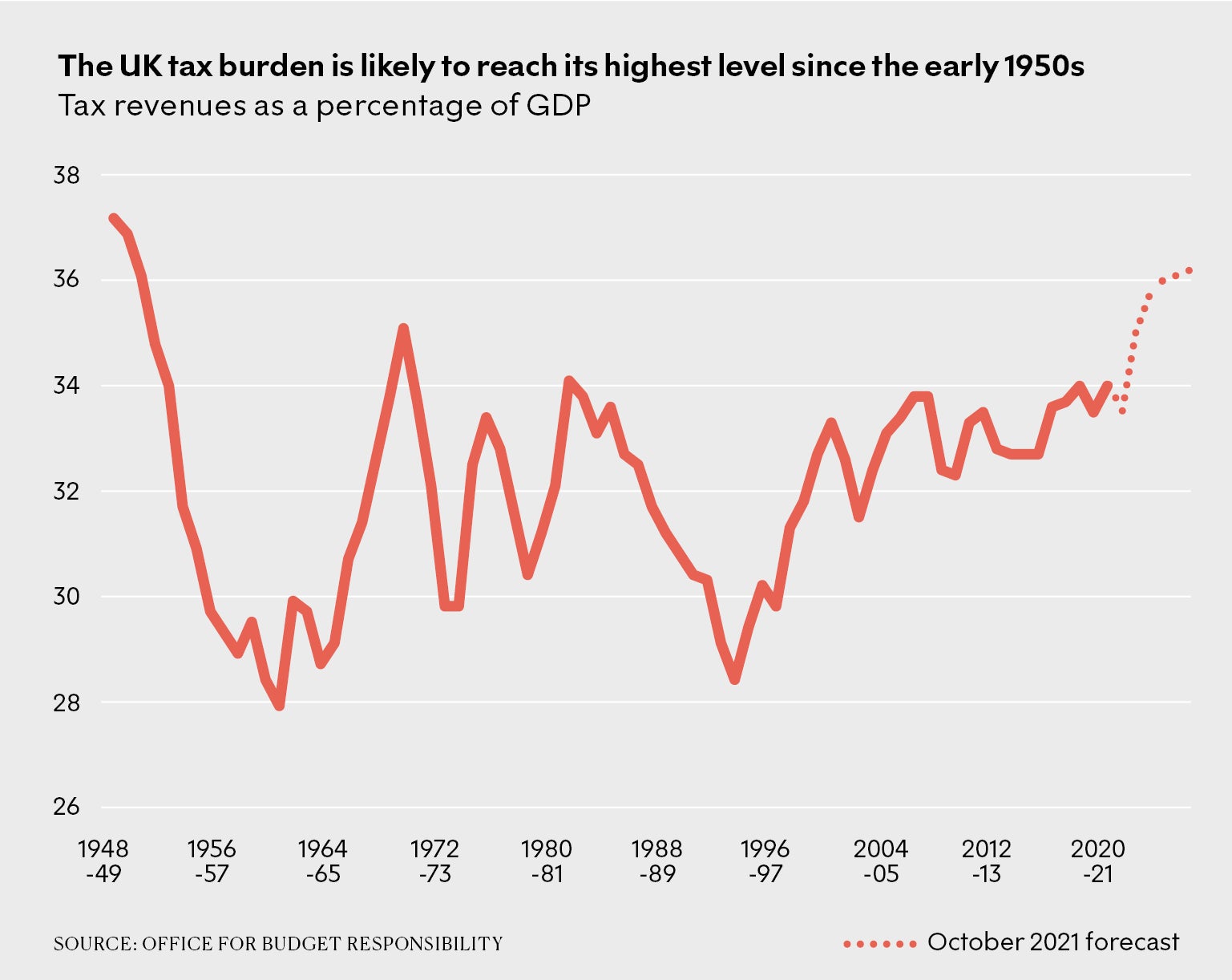

Most UK government revenue is from tax In 202122 total UK government revenue is forecast to be 819 billion or 36 of gross domestic product GDP. Even after recent tax rises the UK remains far closer to the US where the tax burden is just 311 per cent.

Uk Government Revenue Sources 2022 Statista

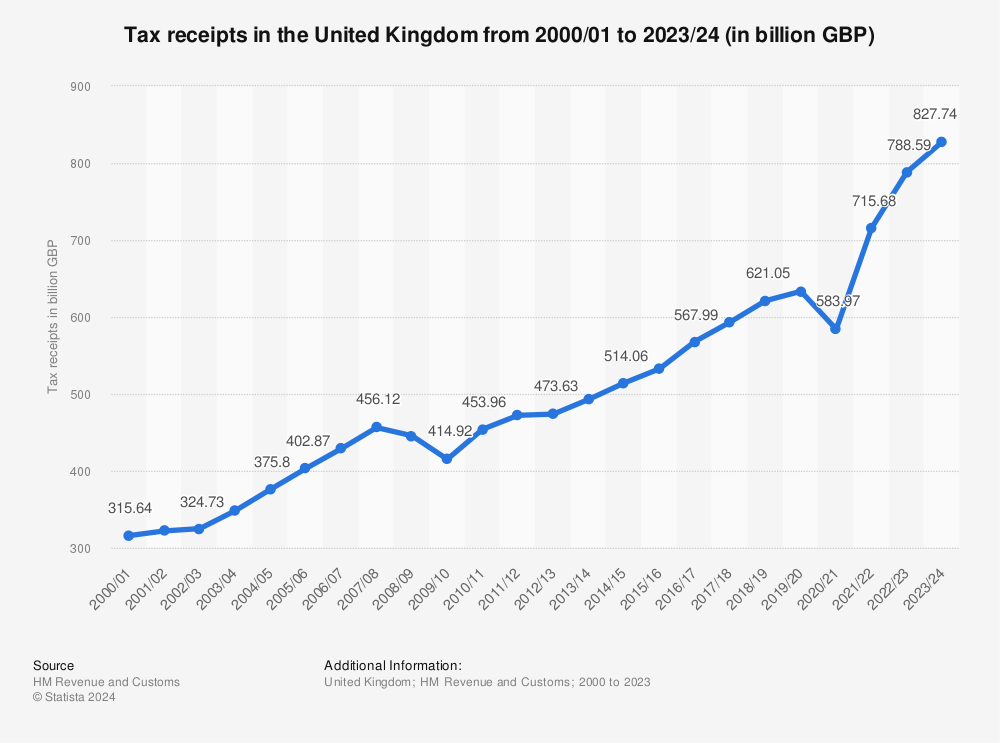

The government raises around 800 billion in revenue each year.

. Much of the revenue initially. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. Ben Tippet is a.

Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m. Most comes from the three biggest taxes. The change since the early 1990s Figure 4 is a continuation of a much longer-term trend.

Income tax National Insurance contributions NICs and VAT. That would be an extra. In 197879 only 11 of income tax receipts were paid by the top 1 of taxpayers.

But if the Office for Budget Responsibilitys OBRs latest official central forecast is correct the pandemic will leave the UK economy permanently 3 smaller than was predicted pre-crisis with knock-on implications for tax revenues. The researchers estimate that up to 20bn extra in tax could be raised by the government if it taxed capital gains and dividends at existing headline income tax rates which is 45 per cent for. - since 198081 Scotland has contributed 222 billion more in tax revenues than if it had just matched the per capita.

Growing income inequality and policy change. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. Thats a big difference - 10000 extra for the government.

The companys indirect tax bill came to 106bn up from 854m driven by VAT on increased sales and employee taxes as it took on more people and increased wages. The personal allowance tax-free income in 20202021 is the same as last year at 12500. In Germany the tax burden is 463 per cent and in Italy it stands at 475 per cent.

In 202021 corporation tax receipts in the United Kingdom amounted to approximately 521 billion British pounds a decrease of around 116 billion pounds when compared with the previous year. A basic tax rate of 20 applies to everyone who earns between 12501 and 50000. - in 201112 Scotland contributed 569 billion in tax revenue which is equivalent to 10700 per person compared to 9000 per person for the UK as a whole.

With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont. The Conservatives are hamstrung by their manifesto commitment not to raise any of the three main rates of taxes. This is 55 higher than it was in 20182019 11851 and is set to increase to 13030 in 20212022.

The share of income tax paid by the top 1 has increased from 25 in 201011. France where social welfare spending is significantly higher 31 per cent of GDP than in Britain 21 per cent has the highest tax burden 517 per cent after Finland 522 per cent. In 2021-22 we estimate that income tax will raise 2132 billion.

Lower than usual growth in receipts of 24 billion 07 in the tax year April 2020 to March 2021 is likely dampened by a combination of reduced economic activity leading to lower tax. This represented a net increase of over 402 billion pounds when compared. This upper limit is 79 higher than it was in 20182019 46351.

As a result the OBR projects that without further spending cuts or tax rises public borrowing will remain at around 4 of GDP 100bn. It would need to impose a permanent annual increase in taxes or cut in spending equal to 43 per cent of GDP 84bn in todays money in 2022-23. National insurance income tax.

Amazon said that when both direct. There are two important sources of this change. After making this assertion he cited the following figures.

This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of national income. The main reason that income tax is the biggest source of revenue is that personal income makes up the majority of total national income.

Pin On Making Money Online The Right Way For Anyone

Moray Agrees 3 Council Tax Rise And Jobs Set To Go

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

How Do Taxes Affect Income Inequality Tax Policy Center

Shortly After The Liberation Of Jerusalem England And France Taxed Their Entire Countries To Fight Salah Al Din Islam And Science Islam Facts Religious Quotes

2022 Capital Gains Tax Rates In Europe Tax Foundation

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

It S Time To Love Payroll This September Details Here Https Fmpglobal Co Uk Blog Its Time To Love Payroll This September Utm Cam Payroll Taxes Payroll Blog

The Rise Of High Tax Britain New Statesman

How To Pay Taxes On A Credit Card And Get Rewards Business Credit Cards Credit Card Payoff Plan Credit Card

Magoz Illustration About Why Women S Products Often Cost More It S Unfair And It S Called The Pink Tax Illustration For Papel Aug Pink Tax Creative Ads Pink

Australia Tax Income Taxes In Australia Tax Foundation

Pin On Road To Revolution Project

How Do Taxes Affect Income Inequality Tax Policy Center

Did Onondaga County Residents Win Or Lose In First Year Of U S Income Tax Reform First Stats Are In Income Tax Onondaga County Income